capital gains tax canada vs us

Bullion and coins are liable to capital gains tax across Canada subject to personal-use property exemptions. Canada Last reviewed 01.

Capital Gains Taxes Explained Short Term Capital Gains Vs Long Term Capital Gains Youtube

Marginal tax rates are composed of a federal component which is paid in the same amount by all Canadians and a provincial component which varies depending on which province you live in.

. In any case if your sale price is higher than your purchase price realized capital gain 50 of your profit will be added to your taxes. Under Canadian tax law individuals need to pay tax only on 50 percent of their capital gain instead of paying tax on 100 percent of the capital gain. Many countries impose a tax on income paid to foreign investors whether its dividend or interest income.

And Canada have considerably different systems of taxation related to the estates of deceased persons. The amount of tax youll pay depends on. The capital gains inclusion rate is 50 in Canada which means that you have to include 50 of your capital gains as income on your tax return.

The tax rate for these transactions is identical to the individuals marginal tax rate. When a Canadian resident non-citizen of the US sells their vacation property in Florida any capital gain realized is subject to US tax and withholding but is also subject to Canadian tax. And the tax rate depends on your income.

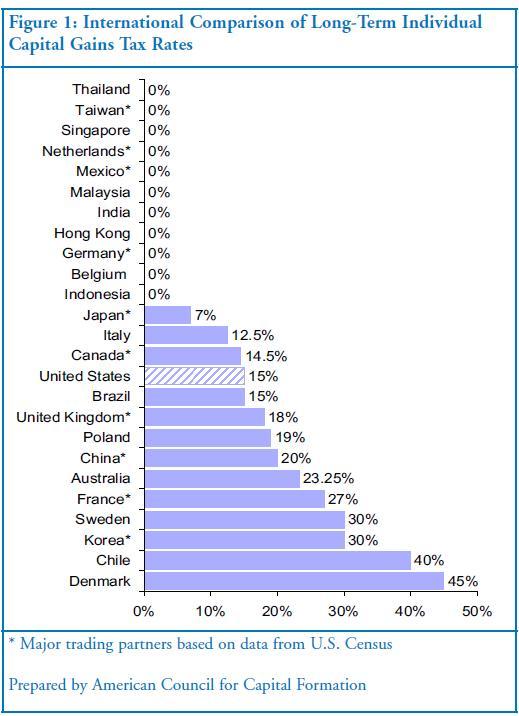

The US tax rates applicable to long term capital gain gain on capital property owned for more than 12 months are generally 15 or 20 there are technically 3 tax brackets on capital gains for. Headline corporate capital gains tax rate Headline individual capital gains tax rate Albania Last reviewed 11 January 2022 15. The only time capital gains tax comes into play is when the recipient of the RSUs choose to not sell the stock immediately and it appreciates in value before selling it.

Adjusted Cost Base ACB. For dispositions of qualified farm or fishing property QFFP in 2021 the LCGE is 1000000. For a Canadian who falls in a 33 marginal tax bracket the income earned from the capital gain of 25000 results in 8250 in taxes owing.

The corresponding bottom Canadian bracket. Taxed at 50. The capital gains tax is 15 and therefore you would pay 16500 110000 USD x 15 in taxes from.

In our example you would have to include 1325 2650 x 50 in your income. Because you only include one-half of the capital gains from these properties in your taxable income your cumulative capital gains deduction is 446109 half of 892218. Youll owe either 0 15 or 20.

Her Majesty the Queen 2008 FCA 24 Primary and Secondary Intention. Capital Gains Tax As the example above outlines when RSUs are issued to an executive or employee they are taxed at the ordinary income rate. This means the tax rate on capital gains in canada is half of your marginal tax rate the rate top rate bracket your income falls into.

United States Last reviewed 01. Estates in Canada For Canadian purposes a Canadian resident is deemed to have disposed of all property owned at the date of death at fair market value thus triggering capital gains tax on any unrealized capital gains. The listed personal property rules state that coins with a resale value and gain of 1000 or less are exempt from capital charges.

Citizens who pay withholding taxes under the treaty generally pay 15. According to the treaty US. Canada Safeway Limited v.

Ordinary Income Tax vs. In the US capital losses can reduce capital gains and up to 3000 of regular income. In Canada 50 of the value of any capital gains is taxable.

See the United Kingdoms individual tax summary for capital gain rates. In Canada capital losses can only be used to reduce capital gains. The inclusion rate on capital gains and losses is 50.

The sale price minus your ACB is the capital gain that youll need to pay tax on. Canadian capital gains are taxable at 50. In the US the lowest tax bracket for the tax year ending 2022 is 10 for an individual earning 10275 and jumps to 22 for those earning 41775.

It would result in paying taxes in the US as the Canadian taxes paid on the 50 portion of the capital gain is not enough to offset the US taxes on the capital gain. WOWA calculates your average capital gains tax rate by dividing your capital gains tax by your total capital gains. Capital gains tax canada vs us.

Long-term capital gains are taxed at lower rates than ordinary income and how much you owe depends on your annual taxable income. A Canada shall allow a deduction from the Canadian tax in respect of income tax paid or accrued to the United States in respect of profits income or gains which arise within the meaning of paragraph 3 in the United States except that such deduction need not exceed the amount of the tax that would be paid to the United States if the resident were not a United States citizen. If capital losses in one year are more than capital gains you can use it to reduce capital gains in up to three previous years or any future year.

Canada 1995 SCR 103 Capital Property or Business Income. It will also be taxed as if you were selling Canadian shares since the capital gains or losses will be taxable in Canada. Helping business owners for over 15 years.

Long-Term Capital Gains Taxes. The Queen 2014 TCC 208 Unsolicited Offers. The us tax rates applicable to long term capital gain gain on capital property owned for more than 12 months are generally 15 or 20 there are technically 3 tax brackets on capital gains for this purpose.

If losses are 3000 more than gains you can carry them forward. Your capital gain from the sale of the property would be 110000 USD. While the tax rate can vary from country to country Canadian investors are generally subject to a 15 withholding tax for dividend payments from US.

Canadian investors are forced to pay capital gains tax on 50 of their realized capital gains. If you are being audited for the sale of property call us today to see how we can help. Having no tax charge is a huge advantage and why buying bullion in Canada is sought after.

Five years ago you purchased your vacation property for 90000 USD and have now sold it for 200000 USD would make you fall under the 23-35 tax bracket. Annual tax applies to any distributions received other than return of capital.

A Big Mistake Joe Biden Wants To Hike Capital Gains Taxes Capital Gains Tax Germany And Italy Capital Gain

Canada Capital Gains Tax Attribution Rules In Canada Versus The Us

Capital Gains Tax What It Is How It Works Seeking Alpha

Can Capital Gains Push Me Into A Higher Tax Bracket

5 3 Explanation Interpretation Of Article V Under U S Law Canada U S Tax Treaty Rental Income Interpretation Real Estate Rentals

Capital Gains Tax Calculator For Relative Value Investing

Difference Between Income Tax And Capital Gains Tax Difference Between

Us Crypto Tax Guide 2022 A Complete Guide To Us Cryptocurrency Taxes

Capital Gains Tax What Is It When Do You Pay It

Capital Gains Tax Calculator For Relative Value Investing

Avoiding Capital Gains Tax On Real Estate How The Home Sale Exclusion Works 2021

Obama Should Leave The Capital Gains Tax Rate At 15 Seeking Alpha

Capital Gains Tax Capital Gain Integrity

Capital Gains Yield Cgy Formula Calculation Example And Guide

What Is Investment Income Definition Types And Tax Treatments

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)